Tax return filing and payment deadlines extended by two months March 23 2020. Personal income tax filing Form BE deadline.

Income Tax Deadlines For Companies Malaysian Taxation 101

Within 1 month after the due date.

. Tuesday 08 Mar 2022 PETALING JAYA. However with this extension taxpayers have a total. Yearly remuneration statement Form EA Deadline.

By 30 April without business income or 30 June with business income in the year following that YA. The tax submission deadline under ITA is usually within 7 months after the end of accounting period. For example a company that closes its accounts on 30 June of each year is taxed on income earned during the financial year ending on 30 June 2022 for year of assessment 2022.

The deadline for filing income tax in Malaysia also varies according to what type of form you are filing. Employment income BE Form on or before 30thApril Business income B Form on or before 30thJune ONLINE Employment income e-BE on or before 15thMay Business income e-B on or before 15thJuly Date of online submission may subject to change. By 31 March of the following year.

General submission due date. For Labuan entities taxed under the Malaysia Income Tax Act 1967 ITA the 3-months extension only applies to taxpayers whose accounting period ended on 30 November 2020 and 31 December 2020. Tax returns Under the self-assessment system companies are required to submit a return of income within seven months from the date of closing of accounts.

Workers or employers can report their income in 2020 from March 1 2021. Form EA Important Notes. The new deadline for filing income tax returns in Malaysia is now 30 June 2020 for resident individuals who do not carry on a business and 30 August 2020 for resident individuals who do carry on a business.

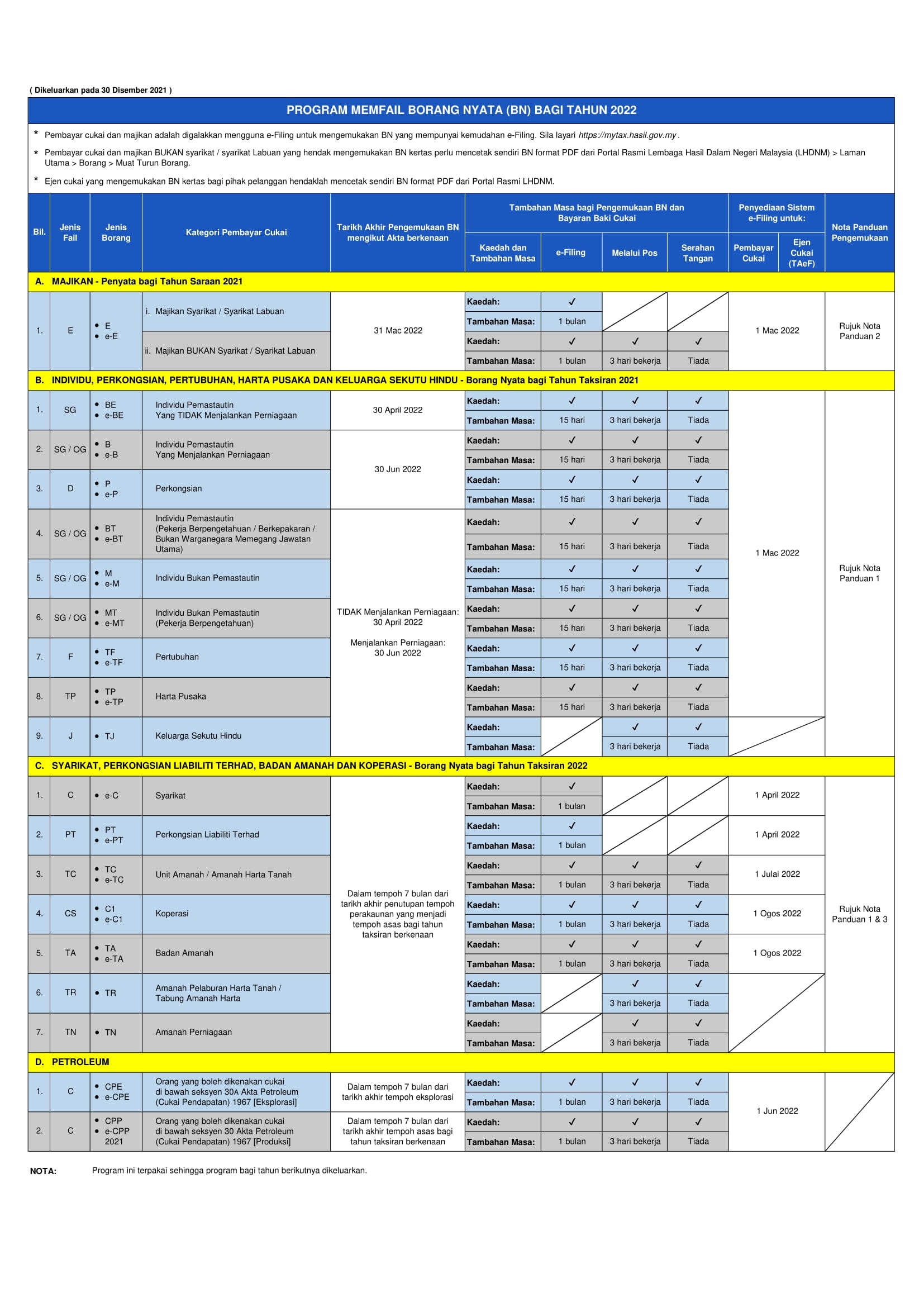

2021 income tax return filing programme issued. The Inland Revenue Board IRB has recently made available on its website the 2021 income tax return filing programme 2021 filing programme titled Return Form RF Filing Programme For The Year 2021. Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs.

Average Lending Rate Bank Negara Malaysia Schedule Section 140B. Individual income tax return No business income With business income Statutory deadline March 31 2020 April 30 2020 June 30 2020 Existing grace period - based on method of submission Electronic filing 1 month. Form E Non-company Non-Labuan company employers 31 March 2022.

The Inland Revenue Board LHDN will not offer any extension period and reminded all taxpayers to submit their tax return within the stipulated timeBut it said an additional 15 days would be given to those who submit their BE and B forms via the efiling system. The penalty will be imposed if there is a delay in the submission of your Income Tax Return Form. The CP38 notification is issued to the employer as supplementary instructions to clear the balance of tax liability of employees over and above the Monthly Tax Deductions MTD 30th June 2022 is the final date for submission of Form B Year Assessment 2021 and the payment of income tax for individuals who earn business income.

Foreign income remitted into Malaysia is exempted from tax. The deadline for submitting Form E is March 31. The deadline for Form B and P is June 30.

For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021 for manual filing and 15 May 2021 via e-Filing. All Income Tax Return Forms must be submitted within 30 days from the date stated on the form or for period that has been set by the government. Thus the new deadline for filing your income tax returns in Malaysia via e-Filing is 30 June 2020 for resident individuals who do not carry on a business and 30 August 2020 for resident individuals who carry on a business.

Malaysia has implementing territorial tax system. For the BE form resident individuals who do not carry on business the deadline falls on either 30 April 2022 manual filing or 15 May 2022 e-Filing. The Malaysian Inland Revenue Department LHDN officially announced the 2021 income tax filing deadline.

You can see the full amended schedule for income tax returns filing on the LHDN website. The deadline for BE is April 30. This will give you unnecessary costs that could have easily been avoided.

The 2021 filing programme is broadly similar in concept to the position laid out in the. The Malaysian tax year runs from January 1st - December 31st. Information on Taxes in Malaysia.

15 May 2021 4. Meanwhile for the B form resident individuals who carry on business the deadline is 15 July for e-Filing and 30 June for manual filing. Form BE deadline.

Form to be received by IRB within 1 month after the due date. Form B Form B is submitted by individuals with business income other than employment income for example sole proprietorship or partnership. Malaysia Business Income Tax Deadlines for 2022 Davina Huang January 25 2022 1.

Both residents and non-residents are taxed on income accruing in or derived from Malaysia. The deadline for filing your tax return depends on where your income comes from. New income tax reliefs for YA 2021 Here is a list of new tax incentives announced for 2022 or YA 2021.

Form E Important Notes. Form B Form B deadline. Within 3 working days after the due date.

Other entities Submission of income tax return. Deceased persons estate Association. 30 April 2021 E-filing submission deadline.

For further information kindly refer the Return Form RF Program on the IRBM Official Portal. Declaration report of companies Form E deadline. The income tax deadline is usually on April 30 manual submission or May 15 e-Filing so you could set it some time at the start of April to give yourself extra time if anything goes wrong.

The income tax rate for resident individuals is reduced from 14 to 13 on taxable income in the range of RM50001 to RM70000 for the Year of Assessment ending 31 December 2021. For further information consult the dedicated page on the official website of the Inland Revenue Board of. If you need extra reminders you could excuse our self-promotion sign up for our newsletter or subscribe to our Facebook and Instagram page.

B Via postal delivery. If youre self-employed for instance then the deadline is June 30th. However if you derive income from employment then you have to file your taxes before April 30th.

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Individual Income Tax In Malaysia For Expatriates

Income Tax Malaysia A Definitive Guide Funding Societies Malaysia Blog

Income Tax Refund Check Eligibility Process To Claim Tax Refund

Malaysia Personal Income Tax Guide 2021 Ya 2020

Important Dates For 2022 Tax Returns Leh Leo Radio News

Personal Income Tax E Filing For First Timers In Malaysia

Ebi Software Kindly Take Note On The Income Tax Submission Deadline In 2022 For 2021 Calendar Year To Avoid Penalty Ebi Ebipos Ebisoftware Possystems Taxsubmission Incometax Lhdn Taxseason2022

Extend Due Date Immediately Trends As Income Tax Return Itr Last Date For Ay 2022 23 Nears The Financial Express

No Extension For Income Tax Filing The Star

Tax Filing Deadline 2022 Malaysia

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

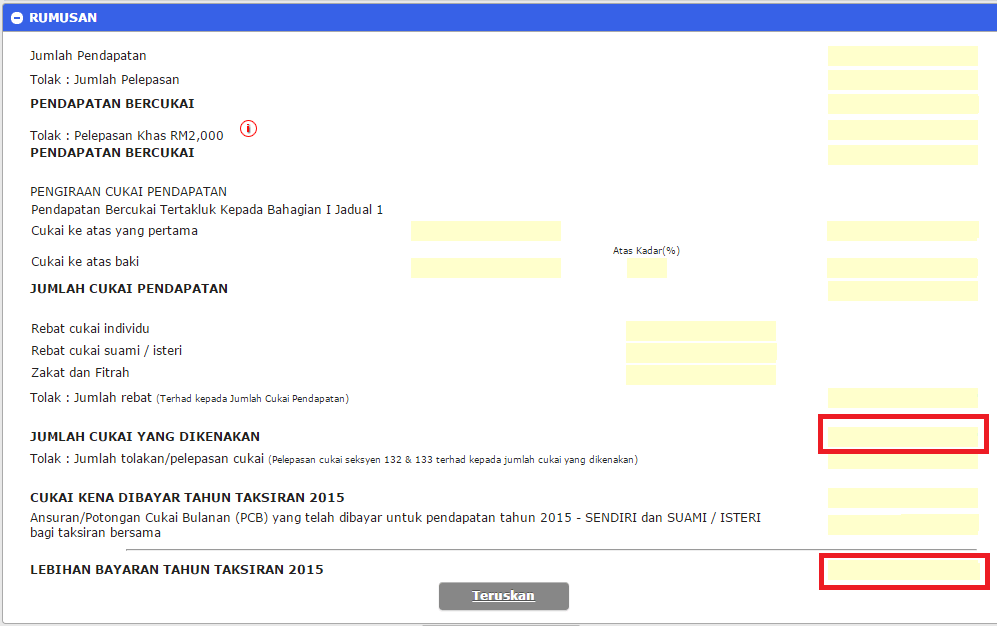

How To Step By Step Income Tax E Filing Guide Imoney

Personal Income Tax E Filing For First Timers In Malaysia

Income Tax Malaysia A Definitive Guide Funding Societies Malaysia Blog

𝗧𝗮𝘅 𝗳𝗶𝗹𝗶𝗻𝗴 𝗗𝗲𝗮𝗱𝗹𝗶𝗻𝗲𝘀 𝗳𝗼𝗿 𝟮𝟬𝟮𝟭 Ks Chia Associates Facebook

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Guide To Using Lhdn E Filing To File Your Income Tax